The company also collected all its outstanding receivables which reduced its operating cycle from 122 days to 75 days.

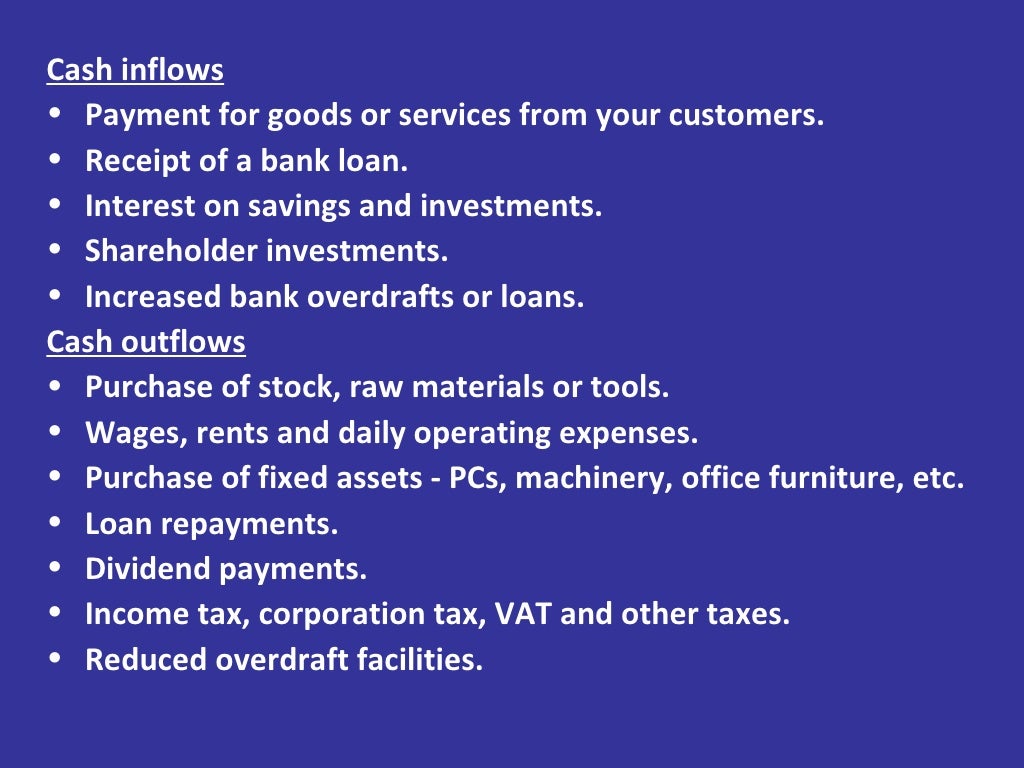

However, Previse revealed that businesses tend to pay their smaller suppliers 30 days later than their bigger counterparts.Ī study conducted by the FSB in the UK showed that nearly 50,000 SMEs close each year due to slow payments! On a study done by Nexus, 51% of suppliers claim that they received more late payments in 2021 compared to previous years. These late payments vicious cycle has a crippling effect on the supply chain. Overall, 43% of invoices were paid late by UK companies. US companies take an average of 51 days more to settle invoices to UK firms. The US receiving the largest value of invoices was the worst late payer in 2019. Late payment phenomenon is a significantly growing trend in the US and the UK. This is one of the biggest cash flow issues affecting businesses.Īs businesses need to pay expenses, a delayed payment reduces cash inflows while adding pressure to pay bills on time.īusinesses might be falling in a vicious cycle of inability to make payments (suppliers, loans, salaries) that may cause them to collapse.

0 kommentar(er)

0 kommentar(er)